nevada estate tax rate

Property Tax Rates Linda Jacobs Washoe County Treasurer. The median property tax in Nevada is 174900 per year for a home worth the median value of 20760000.

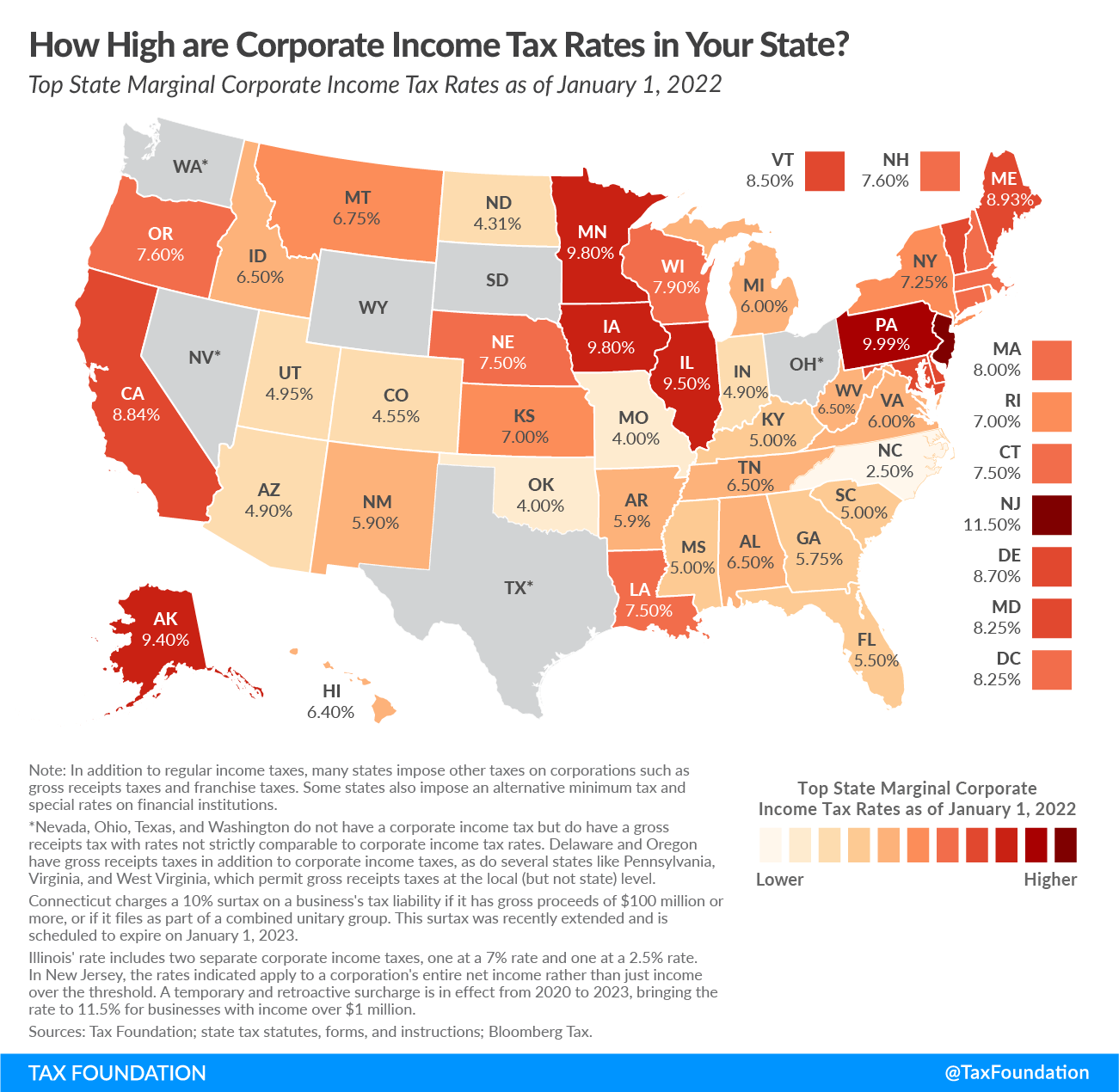

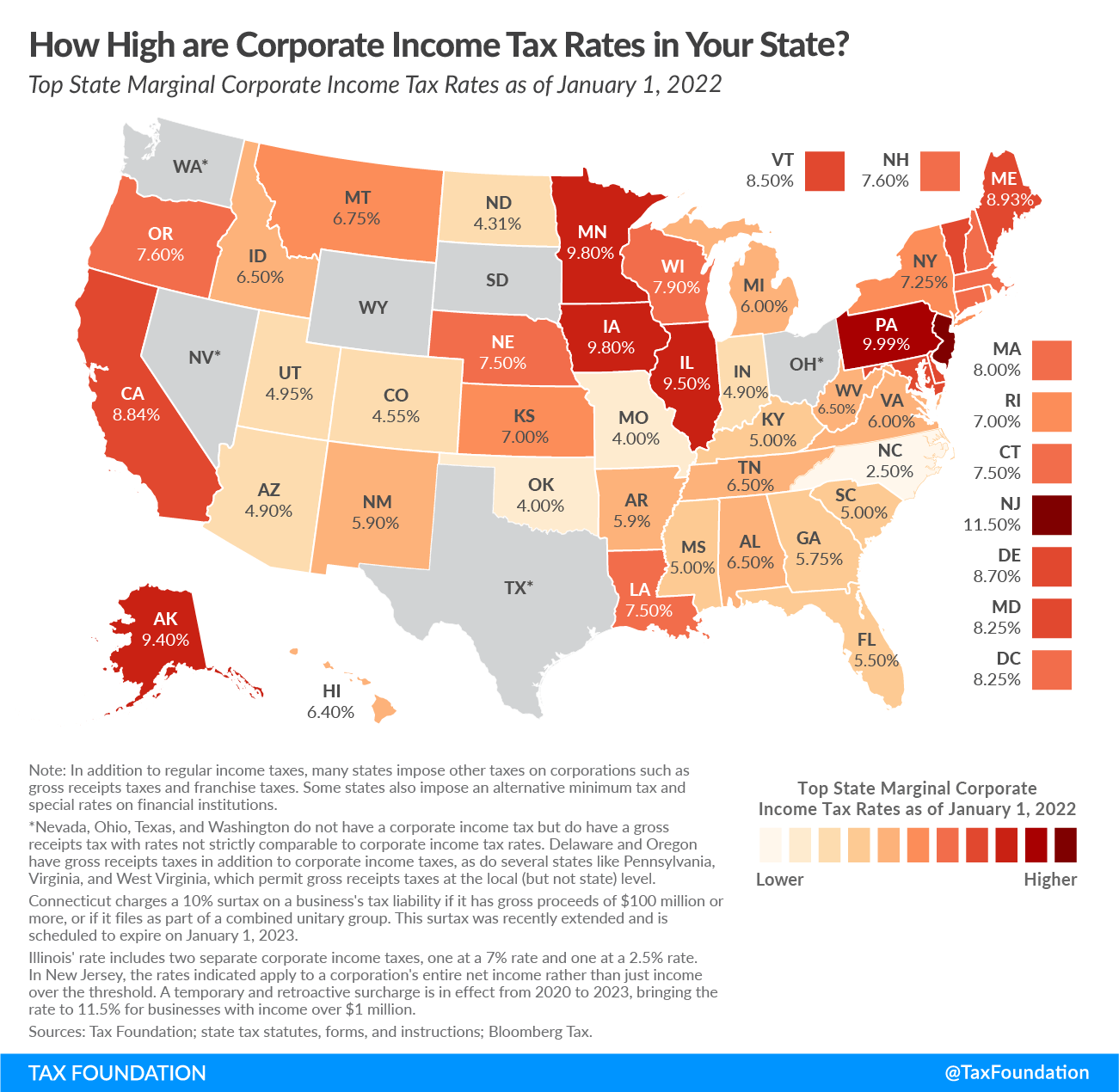

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

Federal estate tax The federal estate tax will be applied if your inheritance is more than 1158 million in 2020 though you will be taxed on the overage not the entire.

. The states average effective property tax rate is just 053 which is well below the national average of 107. The property may be redeemed by payment of taxes and accruing taxes penalties and cost together with interest on the taxes at the rate of 10 percent per annum from the original date. Nevadas tax system ranks.

If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the Death Tax. Nevadas property tax rates are among the lowest in the US. Meaning a homeowner wont ever see an increase in property tax of more than three percent.

Ninth Street Reno NV 89512. Sets the current and delinquent tax rates. Tax Rate 32782 per hundred dollars Determine the assessed value by multiplying the taxable value by the assessment ratio.

For more information visit their web. The office distributes the tax dollars to the various taxing entities including the state county school district cities libraries and other special districts. Frequently a resulting tax bill discrepancy thats 10 or more above the samplings.

Here is a list of states in order of lowest ranking property tax to highest. Right now the tax cap in our state is at three percent for a primary home. You may also call the Department of Taxation Division of Local Government Services - Audit.

Nevada City CA 95959. The County Recorder is your primary source of information about the Real Property Transfer Tax. The amount of taxes payable annually on a property is calculated by multiplying the assessed amount by the tax rates established by the taxing authorities that provide public.

Then comes a matching of these real properties respective tax assessment amounts within each group. Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues. 200000 taxable value x 35 assessment ratio 70000.

Counties in Nevada collect an average of 084 of a propertys assesed fair. Nevada has a 685 percent state sales tax rate a max local sales tax rate of 153 percent and an average combined state and local sales tax rate of 823 percent. Real Estate Tax Rate.

Taxes In Nevada U S Legal It Group

Nevada Inheritance Laws What You Should Know

Taxes In Nevada U S Legal It Group

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Don T Die In Nebraska How The County Inheritance Tax Works

Nevada Tax Advantages Luxury Real Estate Advisors Las Vegas Real Estate

Nevada Income Tax Calculator Smartasset

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Nevada Income Tax Calculator Smartasset

City Of Reno Property Tax City Of Reno

Nevada Inheritance Laws What You Should Know

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Nevada Vs California Taxes Explained Retirebetternow Com

Nevada Tax Rates And Benefits Living In Nevada Saves Money

Nevada Income Tax Calculator Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

States With No Estate Tax Or Inheritance Tax Plan Where You Die